- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Direct Indexing: The Potential for Immediate and Continued Benefits

The benefits of direct indexing may not disappear when loss harvesting opportunities diminish.

- Direct Indexing

Executive Summary

Direct Indexing has been increasing in popularity and may consider table stakes in order to stay competitive within the high-net-worth client segment of the intermediary channel. The benefits are clear when loss harvesting is conducted and losses are used to offset gains from other investments, especially early on in the account’s lifespan.

This process reduces tax outflows. However, the benefits of a direct indexing strategy do not end there. They may continue on as those tax savings stay invested and compound over the years. This paper discusses and quantifies the continuing benefits of direct indexing strategies.

Reviewing the Early Benefits of Tax Loss Harvesting

Most direct indexing strategies offer two main advantages. The first is the ability to customize the account in line with the client’s preferences (e.g., not holding a stock to which the client is exposed elsewhere, or ESG considerations), which we will discuss in another paper. Here, we will focus on another important benefit – tax management.

To review, by owning the individual stocks in an index (or typically a subset), a savvy manager can take advantage of the equity market’s natural volatility by selling individual names as they fall below their cost basis. This cannot be done in a fund as the fund will have only one holding that will either increase or decrease in value.

However, within the index, there are almost always stocks that are down no matter what the overall equity index is returning. Direct indexing managers will replace the stocks that have been sold at a loss with a similar (but not the same, given the IRS wash sale rules) basket of stocks so that the account can continue to track the index with a typically small tracking error (relative risk of the account versus the index).

The capital losses generated by the direct indexing manager can then be used to offset capital gains from other investments on the client’s IRS schedule D, thus saving money that otherwise would have been taxable. (Losses not used in the current tax year can be carried forward indefinitely.)

This can be very valuable, especially for clients in a high tax bracket, high tax state and/or clients with significant short-term capital gains outside the direct indexing (DI) account.

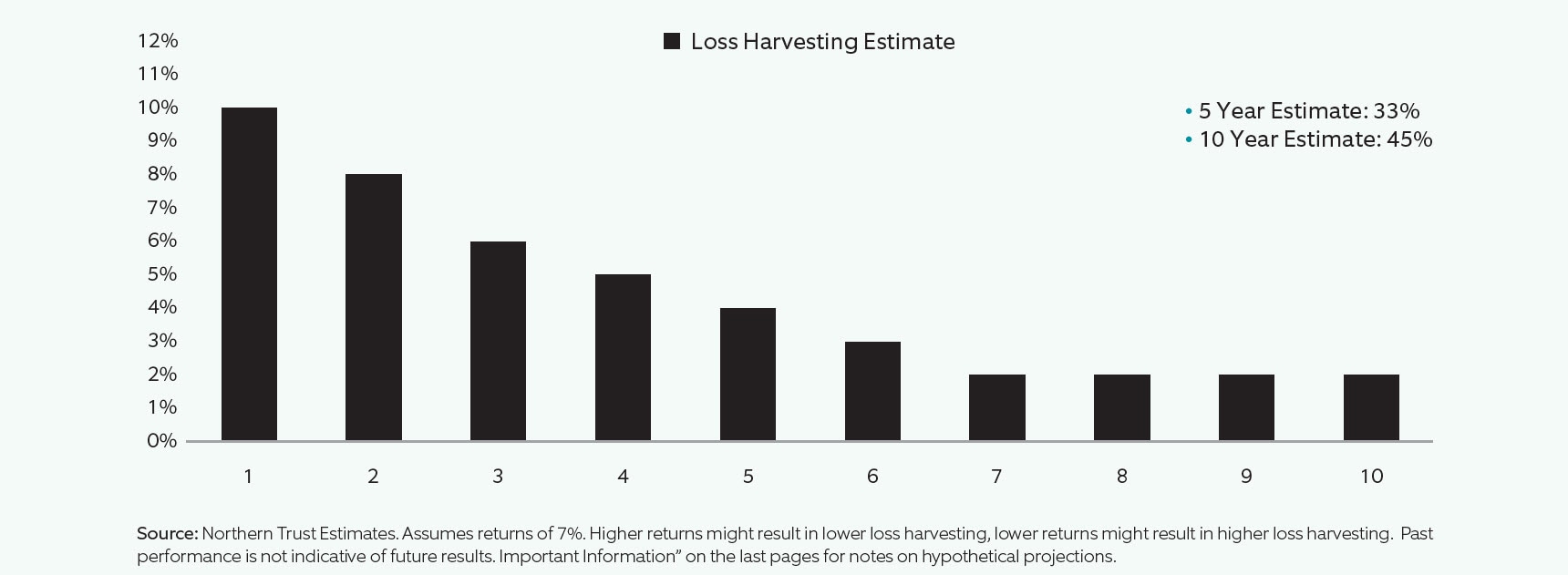

Exibit 1: Loss Harvesting Estimate as a Percentage of Initial Value by Year Since Inception

Exhibit 1 shows Northern Trust Asset Management’s (NTAM) estimates of the amount of losses that can be expected to be generated from an all-cash funded Separately Managed Account (SMA) that regularly harvests losses.

At NTAM, we seek to harvest losses on a monthly cadence (again outside the wash sale period) in order to capture losses when they are available and reinvest dividend income. Assuming a reasonable market return of 7% and typical volatility, we can see loss generation starts out very strong and tends to decline over time.

In the later years, the losses are mostly derived from reinvesting dividends and cash from corporate actions. Note that in year one, all losses will be short-term and new losses from dividends and cash will also be short-term. It is also possible that some long-term holdings might turn into losses due to volatility spikes, down markets, or idiosyncratic stock situations.

The Continuing Benefits from Compounding

We’ve seen that the potential benefits from loss harvesting diminish over time but don’t disappear completely. We now turn to the continuing benefits realized from the compounding of taxes saved.

An illustrative example might help. Let’s assume that in a typical account we were able to generate 10% in capital losses in the first year. So, for a $1 million account, that represents $100,000 in realized short-term losses that can offset $100,000 in realized capital gains, thus resulting in no immediate tax bill for those gains.

This can potentially create a near-term tax savings of anywhere from $40,000 to more than $50,000 (40% to more than 50%) for high-net-worth clients, depending on the client’s state of taxation and the nature of the outside gains.

Those tax savings can potentially remain invested and generate a market return. This is where the continuing benefits come into play. By keeping that money invested, those savings will compound over time. The longer this deferral of gains can be kept going, the better for the client’s after-tax wealth.

One other important fact to mention is that as losses are harvested from a DI account, the cost basis of the account is decreased. This is due to the fact that because stocks are sold at a loss, new replacement purchases are incepted at the lower amount, thus lowering the overall cost basis of the account.

GAIN DEFERRAL

Deferred gains that can be held until death result may result in a step up in cost basis that can eliminate the built-up gain for beneficiaries. In addition, low-cost shares can be donated to charity, providing the same advantage.

The Potential Value of Continuing Benefits

Now let’s look at a hypothetical direct indexing account funded with $1 million in cash and tracking the S&P 500 Index with a low tracking error. We also assume an S&P 500 return of 7%, in line with Northern Trust’s latest capital market forecast.

Exhibit 2a and 2b present the estimated hypothetical cumulative tax alpha of loss harvesting over a 20-year period. We assume that losses can be harvested in the second 10-year period at around 2% of the original balance, similar to the later years of the 10-year periods from Exhibit 1.

For simplicity, we also assume maximum federal tax rates of 40.8% for short-term capital gains and 23.8% for long-term capital gains and no cash inflows. Tax alpha is defined as the amount of losses generated multiplied by the associated tax rate (short- or long-term) divided by the market value of the account.

As you can see in Exhibit 2a below, the cumulative tax alpha from the immediate benefits tends to level off over time at a steady rate. After-tax benefits start out high as the hypothetical account starts with cash and decline over time as the account ages and fewer stocks are at a loss and fewer gains are deferred. This is generally referred to as ossification.

In later years, the account will continue to be rebalanced at a similar frequency no matter its age. This includes reinvesting dividends that accumulate and any cash from corporate actions as well as harvesting available losses. However, loss generation clearly will slow down.

If we add the continuing benefits to the graph, you can see that the total tax alpha, including the compounding of the tax savings invested in the portfolio, continues to grow.

This is modeled by assuming that any tax savings are invested in the DI account as a proxy for other investments. Here we can see the benefits of that compounding of the tax savings.

The benefits of tax savings compounding may become a larger component of the annual tax alpha than the immediate tax savings once the loss harvesting activity slows down, prolonging the benefits.

As mentioned, the longer these tax savings can be deferred, the higher after-tax wealth that can be created. Holding the direct indexing account until death and passing onto heirs will potentially result in the highest benefit given the DI account will experience at step up in cost basis, thus allowing the beneficiary to sell the portfolio tax-free if desired assuming no further appreciation.

Value After Taxes

Next, we look to answer the question of: If we factor in investment management fees for a direct indexer versus simply investing in an index ETF (which can be both inexpensive and tax efficient) does the benefit remain?

If we assume the fee for DI is 25 bps (0.25%) and the fee for an equivalent index ETF is 5 bps (0.05%), we can say the fee differential is 20 bps (0.20%). Expected total annualized tax alpha typically ranges from 1% to 2% depending on the state in which the client resides, the inception date, cash flows, and the market environment.

Even at the lower end of this range the answer to the question posed is yes. Note that we have ignored dividends for this analysis as we assume that dividends and taxes on dividends are similar, whether in an ETF or SMA wrapper.

Potential Considerations for Direct Indexing Accounts

The ability to generate losses may be lower than expected, especially in markets that are rising significantly. Furthermore, the continuing benefits may not be fully realized in flat or falling markets because reinvested tax savings could potentially be low or negative.

Additional Strategies for Seasoned Accounts

It is not uncommon for clients to take additional steps in order to “rejuvenate” the loss harvesting opportunities in direct indexing accounts. Here are a few of the most common practices:

Add cash to the account

Depositing cash into the account will create fresh tax lots that can be turned into future losses. Note that during the first year, losses generated from the fresh cash will be short-term.

Gifting securities from the account

Appreciated direct index portfolios are an ideal source for charitable gifting. Of course, the gift is tax deductible as is gifting cash. However, by gifting low-cost basis securities, the investor removes the tax liability from the account as well. It may be best to replenish the DI account with cash that otherwise would have gone to charity, which would have the impact described in section above.

Conclusion

Direct indexing strategies in separately managed accounts have become very popular with advisors and clients because of the flexibility and benefits they provide, especially the benefits of tax management. There is a misperception in the industry that DI portfolios lose their value after losses slow down.

As we have seen from our analysis, it may not be the case. Gain deferral is a critical component of tax loss harvesting strategies including direct indexing. Deferring gains created in these portfolios, after taking advantage of the potential immediate benefits of offsetting gains from other investments, takes advantage of the power of compounding to potentially increase long-term after-tax wealth.

Model Assumptions

- Return of 7% for the S&P 500

- Tax impacts were calculated using the highest marginal individual tax rates in the U.S.; 23.8% long-term, 40.8% short-term.

- Short-term and long-term losses are credited at the corresponding tax rates.

- Tax alpha is calculated as after-tax excess return — pre-tax excess return.

- Pre-tax excess return is assumed to be zero.

Want to learn more about our direct indexing capabilities?

Contact us or your NTAM sales professional.

IMPORTANT INFORMATION

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Historical trends are not predictive of future results.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee