- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Vigilance Required, but Drivers Remain

The need for a regulation boost, why rare earths may not be so rare, and how AI could lighten the government debt burden.

- Market Commentary

- Portfolio Construction

- Real assets

- Risk Management

Key Points

What it is

Gary explores the growing acceptance of digital assets, the challenges of changing demographics and the promise of AI productivity.

Why it matters

Regulation likely will be critical to the success of digital assets and stablecoins. AI may provide relief for government debt.

Where it's going

Real assets such as gold are proving increasingly valuable against the world’s currencies.

The Weekender is my bi-weekly take on macro shifts and emerging themes. It’s not investment advice — or even our firm’s official view. I aim simply to inform, challenge, and maybe entertain. If you’d like this in your inbox every other Saturday morning via Northern Trust, subscribe to The Weekender.

It’s been a packed week in London with a trio of conferences — digital assets, alternatives and quantitative investing — and a series of client events. Some highlights:

- The Digital Asset Summit coincided with the U.K.’s Financial Conduct Authority lifting retail constraints on digital assets, culminating in a major announcement on Wednesday (more on that shortly).

- At the Billingsgate Fish Market,it was standing room only. What struck me most was the lack of debate around the legitimacy of digital assets — it was assumed. The focus had shifted to infrastructure and application layers.

- Also surprising: the demographics. The crowd was far more seasoned than expected.

- On Tuesday, I participated in a roundtable with commodity and China experts, gaining insights into precious metals (gold/silver), strategic resources (copper/uranium) and rare earths.

- One of the week’s most engaging dinners was with U.K. wealth managers, where we cracked the code on AI productivity, dissected the U.K. budget furiously debated the origins of the Scotch egg, and discovered a CIO whose hobby is collecting calculators (who wouldn’t invest?).

- These face-to-face moments reminded me that creativity is a contact sport, trust requires oxytocin (not possible on Zoom) and team spirit is still found at the bottom of a wine glass.

Risk Management

Until last Thursday, Oct.16, the S&P had gone 119 days without a 2% drop, fostering complacency as implied correlations and volatility neared extremes — leaving markets vulnerable to shocks like President Trump’s Truth Social tweet on Friday, Oct. 10.

These volatility spikes remind us that low realized volatility doesn’t ensure low implied volatility, prompting risk managers to potentially de-risk further, especially with the Chicago Board Options Exchange Volatility Index (VIX Index) spiking, sub-prime bankruptcies (First Brands, Tricolor Holdings), regional bank weakness, trade uncertainty with China, and October’s historical market fragility. However, for now, the sub-prime issues appear idiosyncratic and contained, with fraud allegations not indicating systemic risk. Leverage loan defaults are stable, high yield spreads remain historically low, and bank earnings show improved credit quality.

While we must stay vigilant and monitor the situation closely, absent broader economic deterioration, we remain pro-risk: fundamentals are solid, full expensing of the One Big Beautiful Bill Act (OBBBA) is yet to kick in, the Fed is leaning toward rate cuts, and early earnings show consumer resilience and strong AI capex — underscored by Taiwan Semiconductor Manufacturing Company’s (TSMC) report of tightening AI capacity. While volatility is likely, any material weakness may be bought.

The Path to Truth

I suspect the ; and in the U.S. may do for blockchain, digital assets and stablecoins what the did for the internet. Without regulatory clarity, investor confidence falters. Regulation provides the scaffolding for growth, and the Telecom Act triggered a capex boom.

So, it was timely that on Day 3 of the Digital Asset conference, the FCA announced its support for tokenization to enhance efficiency and innovation in asset management. That same day, David Sachs, current AI czar under U.S. President Donald Trump, declared at the Dreamforce conference that digital assets will be fully integrated into the regulatory system within three years. Add to this the voices of the SEC Chair, the U.S. Treasury Secretary, a majority in Congress and now the U.K.’s FCA, and we’re seeing broad institutional support for on-chain finance, and the tech underpinning them (Ethereum/Solana).

And in terms of real-world adoption, this deal stands out. Walmart has tied up with OpenAI to allow its 150 million shoppers transact via ChatGPT. This will pave the way to agentic commerce and payments, potentially opening another on-ramp for stablecoin proliferation. As German philosopher Arthur Schopenhauer noted, all truths pass through ridicule and rejection before becoming self-evident. Tokenization is past ridicule and rejection, fast on its way to becoming reality. Prepare accordingly.

Gray Power

We’ve often discussed the influence of mega-forces in the Weekender, and demographics top the list. These forces rewrite the rules or render them obsolete. Consider the welfare state: when Western governments designed pension schemes, they assumed each generation would outsize the last, ensuring more contributors than beneficiaries. Reality diverged. In France, the worker-to-pensioner ratio has dropped from 5:1 to below 2:1 and continues to decline. French pensioners not only receive larger checks but also start earlier (at age 63) and now earn more than the working population. True story. Their voting power is formidable (see: fourth PM in nine months) and growing, placing increasing strain on the state.

Solutions? 1) Tax hikes/welfare reform (unlikely — see average PM tenure and ongoing protest), 2) Productivity growth, or 3) More debt, persistent deficits and monetary debasement. While option 3 seems inevitable (good news for supply-constrained real assets), let’s be optimistic. Let’s explore productivity. It’s nearly Christmas, after all.

The Productivity Miracle

Why call it a miracle? Because it might achieve what four French PMs, Elon Musk (and DOGE), and Rachel Reeves couldn’t: reform the welfare state and fix the debt burden. These are U.S. numbers, but the principle is universal. The Congressional Budget Office projects debt-to-GDP at 156% by 2055. Add 0.5% productivity growth, it drops to 130%. Add1%, it falls to 110% and 2% gets you below 100%. That’s meaningful.

While it’s risky to reason by analogy, drawing parallels with the internet boom: Between 1995–2000, labor productivity rose to 2.8% annually, up from 1.0% in the prior five years. If we’re entering a tech-led, non-inflationary boom akin to the late '90s — as U.S. Treasury Secretary Scott Bessent and others suggest — then we could see material benefits to deficits, Federal Reserve rates, discount factors, and long-duration assets like U.S. equities. So, I’m praying for a miracle and that mangoes become the greatest fruit. Ever.

Why MANGOs Are My Favorite Fruit

First came FAANG: Facebook, Amazon, Apple, Netflix, Google. Then the Magnificent 7. Now, in the age of generative AI, we have MANGO— Microsoft, Anthropic, Nvidia, Google DeepMind and OpenAI. Notably absent: Amazon and Meta. Newly included: Anthropic. These are the headline-makers, the dream employers for computer science grads worldwide. FAANG defined an era of domain-specific dominance — social media, mobile, streaming, search. MANGO defines an era where AI reigns supreme. If MANGO succeeds, so too might social welfare.

Bubble Math: Continued

Following our recent piece Beyond the Bubble, here’s more food for thought. Bears cry “bubble,” bulls fear one, but we arguably lack the conditions to call it that. Yes, echoes of the past exist — circular financing is concerning — but prices aren’t divorced from earnings, valuations are high but not extreme, funding is mostly from cash flow, not credit, and system collateral remains scarce and valuable.

Contrast this with the dotcom era’s “dark fiber” overbuild. In a must-listen BG2 Podcast, Nvidia CEO Jensen Huang argues fears of overbuilding are premature. He believes hyper-scalers will consume the current capacity, while general-purpose compute must wait its turn for AI upgrades. This narrative feels more enduring than say, Y2K. If we must label it, skip “bubble” or “mania” — terms defined post-mortem — and consider something observable: Industrial Revolution. We certainly meet the criteria.

Rare Earths Are Not That Rare

One of the week’s more intriguing insights came over lunch with commodity/China experts. Rare earths markets are small — about $7.5 billion last year, roughly the size of avocados. Despite the name, they’re also not rare. They’re globally abundant, but extraction is costly and polluting, making permits hard to obtain. Hence, China’s dominance and the geopolitical leverage.

But that leverage may be fleeting. Some believe China’s restrictions could backfire, prompting the U.S. and others to accelerate stockpiling and infrastructure for specialty materials. Companies like Lithium Americas (+215% year-to-date) and MP Materials (+475% year-to-date) may be early beneficiaries. Uranium stocks are surging, and more investment is likely — from the Office of Strategic Capital, hedge funds (see investor Stan Druckenmiller’s latest purchase, JPM who announced a $10B push into critical minerals, or BHP reopening copper mines due to the “breathtaking level of ambition and urgency” in the U.S. around the supply of critical minerals).

Rare earths may soon be common, driven by a refrain from my youth repeated at lunch: The best cure for high prices is high prices. And prices look poised to climb, thanks to a new buyer with deep pockets and little price sensitivity — the U.S. government.

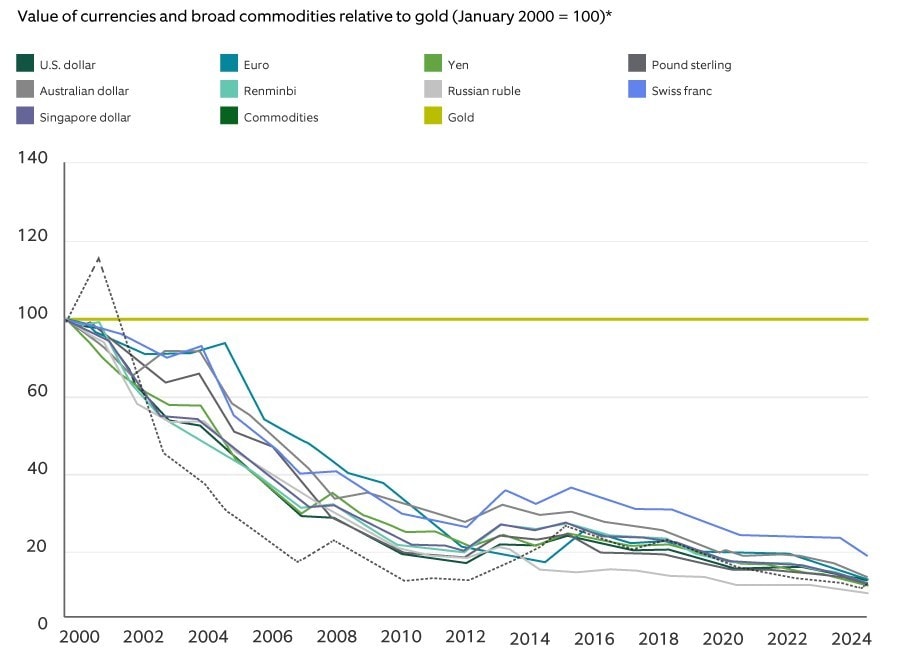

Debasement and Scarce Assets

In The Search for Real Returns, we explored hurdle rates that account for inflation and monetary debasement. Since then, the “debasement trade” narrative has gained traction — not just of the U.S. dollar, but all fiat currencies are under pressure (see Exhibit 1). During fiscal dominance and monetary debasement, it’s wise to own supply-constrained real assets that can’t be printed. Especially those free from sanctions or third-party liabilities. Gold remains the benchmark. central banks still hold proportionately less than in the 1970s, with new buyers like Tether, digital gold, broadening collateral usage and the space industry on the horizon. Silver faces structural shortages and rising demand from energy transition and solar, needing to triple in real terms to reach its peak. Copper is now strategic, not just cyclical. Ditto uranium — and the last 17 metals on the periodic table. Then there’s Bitcoin. Real or not, it’s no longer ridiculed or rejected. Perhaps it too is on the path to self-evidence.

A U.S. law that deregulated the telecom industry to promote competition and expand access to digital services.

U.S. law establishing a federal framework for regulating stablecoins, requiring full reserve backing, issuer licensing, and consumer protections.

U.S. law defining regulatory roles for digital assets, splitting oversight between the SEC and CFTC to clarify crypto market structure.

Digital currencies designed to maintain a stable value by being pegged to assets like fiat currencies, commodities, or other financial instrument.

Exhibit 1: Eroding Currencies

During fiscal dominance and monetary debasement, it may be wise to own supply-constrained real assets that can’t be printed.

*As of 31 December 2024. Relative value between 'gold'. LBMA Gold Price PM, 'commodities'. Bloomberg Commodity Index, and major currencies since 2000. Value of commodities and currencies measured in ounces of gold and indexed to 100 in January 2000. Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Have a great weekend.

Gary

Main Point

The promise of regulation and AI productivity

Regulation of digital assets and stablecoins could provide the scaffolding for growth, as it did in the 1990s for the internet. Small annual increases in AI-driven productivity can significantly impact the government’s future fiscal conditions.

Contact Us

Interested in learning more about our expertise and how we can help?

Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This content may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of Northern Trust Asset Management (NTAM). The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee