- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Case Study

Save to bookmarks

Case Study: Transitioning Equity Portfolios Efficiently

Helping clients switch investment strategies while minimizing tax consequences through direct indexing.

- Direct Indexing

Client Profile

Consider this strategy for clients who are:

- Seeking to replace individual stock holdings or an existing separately managed account (SMA) with another strategy.

- Looking for a simple cost- and tax-efficient transition.

For clients who own underperforming actively managed SMAs or a portfolio of stocks they no longer wish to manage themselves, it could make sense to switch to an index or quantitative strategy.

Liquidating the holdings and reinvesting in an exchange-traded fund (ETF) is one option. However, this could result in a significant tax bill — especially if the securities have appreciated. Furthermore, some securities would likely be included in both the original portfolio and the new strategy. Selling and then rebuying the same securities would incur unnecessary taxes and transaction costs.

So, how can you help your clients transition their portfolios tax-, cost- and risk-efficiently?

SOLUTION: Consider Northern Trust Asset Management (NTAM) direct indexing for a tax-smart transition plan

Since direct indexing accounts can be funded in-kind with individual stocks and ETFs, securities can be transferred without being sold or converted to cash. This allows NTAM portfolio managers to add value by deferring capital gains and transferring assets between accounts more tax- and cost-efficiently.

Direct indexing also offers the potential for enhanced risk management as managers seek to track the chosen index more closely than the original account likely would. Furthermore, in cases where the client holds individual stocks, our managers will implement risk parameters around the holdings.

The NTAM Transition Plan Process

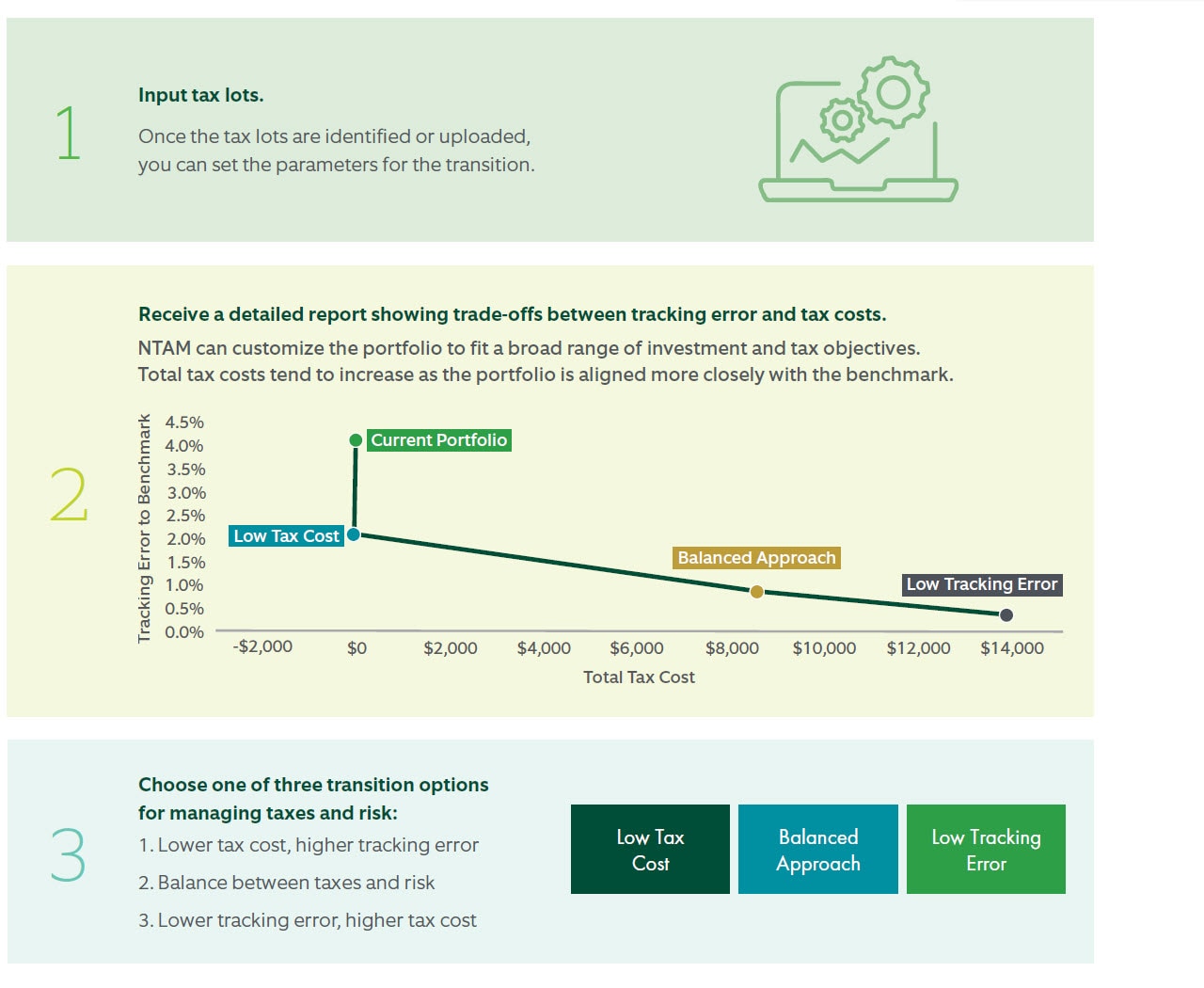

Portfolio transition analyses can be run for both existing clients and prospects. For current clients, we access and analyze the existing tax lots. For prospects, you can upload the account’s tax lots directly into the NTAM Direct Indexing Portal. The process works like this:

With NTAM Direct Indexing, portfolio transitions can accommodate client-specific customization requests, such as exclusions, tilts or ESG considerations. As described above, advisors receive a detailed analysis that shows the implications of each option, including the tax cost (based on the client’s current tax rates), portfolio characteristics and risk parameters.

With this analysis, you can thoroughly understand tax and risk consequences before making a transition recommendation . Finally, when exported to a PDF, the transition analysis becomes an effective visual aid to facilitate client discussions.

Client and Advisor Benefits

Transitioning a portfolio via NTAM Direct Indexing enables your client to save on capital gains taxes while incorporating customization parameters and managing risk. Furthermore, with just a few inputs, the portfolio management team can begin to analyze different scenarios and build an optimized portfolio, enabling you to efficiently add value to your client relationships.

After the transition, your client’s direct indexing portfolio can continue to deliver tax alpha through loss harvesting in the future. Alternatively, the account can be designed to lower tracking error over time by using any losses in the account to offset gains from other potentially outsized positions.

Potential Considerations for Direct Indexing Accounts

The ability to generate losses may be lower than expected, especially in markets that are rising significantly. Furthermore, the continuing benefits may not be fully realized in flat or falling markets because reinvested tax savings could potentially be low or negative.

Good to Know

The tax savings achieved by transitioning accounts using this process is considered tax alpha. This represents the taxes saved from not having to liquidate the entire account.

Be aware: Post-transition tax alphas will be lower than those for accounts funded with cash.

Learn how cutting-edge technology

can help solve investing challenges.

Contact us or your NTAM senior market leader.

IMPORTANT INFORMATION

The case studies presented are intended to illustrate products and services available at Northern Trust. They do not necessarily represent experiences of other clients. Unless apparent from the context, all statements herein represent NTAM’s opinions. Past performance is not indicative of future results. Individual results may vary.

This content may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of Northern Trust Asset Management (NTAM). The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide a recommendation or give investment advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and/or its affiliates may receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee

For use with Financial Professionals only. Not for retail use.