- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

The AI Rally’s Achilles Heel

U.S.-China frictions continue, highlighting that greater volatility is likely not a bug of the current trade stand-off but a feature of the emerging geopolitical landscape.

- Portfolio Construction

- Fixed Income Insights

- High Yield Strategy

- Risk Management

Key Points

What it is

Recent policy moves by the U.S. and China have injected fresh uncertainty into AI-linked stocks.

Why it matters

Shifting policies could quickly impact investor confidence and market direction.

Where it's going

While risks remain, economic self-interest points to eventual compromise over confrontation between the U.S. and China.

The sudden re-escalation of U.S.-China trade tensions — manifested in Washington's retaliatory tariff threats and Beijing’s calculated throttling of rare earth exports — has returned a familiar, unwanted chill to global markets. Uncertainty, the bane of capital, is again ascendant.

The immediate anxiety will likely persist through the middle of November. Big deals require last-minute theatre, and the recent tit-for-tat moves — China restricting access to vital minerals, Washington threatening 100 percent tariffs — are less a total collapse than a predictable stage of high-stakes negotiation. Escalation is now a fundamental tactic.

Beijing knows its leverage: it holds a near-monopoly on the processing of rare earth metals, essential for everything from consumer electronics to advanced defense systems. Washington's counter-lever is access to its vast domestic market and its insurmountable lead in advanced technology, particularly semiconductors and the know-how underpinning the entire Artificial Intelligence (AI) value chain. China requires the latter to fulfill its technological ambitions; the U.S. needs the former to maintain global manufacturing efficiency.

The critical variable remains the incentive for a deal. Both sides have too much to lose to let negotiations fail entirely. The economic costs of a full decoupling — slower growth, higher inflation, and deeply disrupted supply chains — are catastrophic for the world's two largest economies. Rational self-interest dictates that an agreement, however fragile or temporary, will be reached. Expect a choreographed climb-down before the final deadline.

Yet, even a limited trade pact will not dispel the technology-led vulnerability that has permeated equity markets. The recent rally in both Chinese and U.S. stocks is rooted heavily in optimism around AI and its related technological infrastructure. The constant escalation around access and restrictions in the broader tech value chain — U.S. chip controls versus Chinese rare earth controls — is a direct attack on the future earnings of these high-flying companies. This friction acts as a structural fault line, meaning that greater volatility is not a bug of the current trade stand-off but a feature of the emerging geopolitical landscape.

— Peter Wilke, CFA – Head of Tactical Asset Allocation, Global Asset Allocation

Interest Rates

For decades, the Federal Reserve has used the Federal Funds Target to communicate and implement monetary policy. Targeting the interest rate on unsecured, overnight loans between banks has been standard market lingo for generations of traders. But the market for Fed Funds has evolved meaningfully since the 2008 financial crisis, with daily volumes a fraction of what they were, and the number of daily participants dwindling. Comments from Dallas Fed President Lorie Logan recognizing these changes, and suggesting alternative target rates, brought needed attention to how the “target” may evolve. There are good reasons to pay attention to Logan: she oversaw the Fed’s Portfolio and spent many years in the Markets Group at the New York Fed.

Potential Fed Funds replacements are measures of – secured overnight loans between a mix of market participants. Daily volumes are in the trillions. is the ‘cleaner’ measure of the two, but lacks a deep derivatives market, and was named the replacement for the several years ago. While we don’t expect Fed Funds to go away quickly, we do think it makes sense to consider alternative target rates.

— Dan LaRocco, Head of U.S. Liquidity, Global Fixed Income

The SOMA portfolio is managed by the Federal Reserve Bank of New York and contains assets acquired through open market operations. These assets — primarily U.S. Treasuries and agency securities — are used to implement monetary policy, manage liquidity, and serve as collateral for Federal Reserve liabilities.

LIBOR was a global benchmark for short-term interest rates based on estimates from major banks. It has been phased out due to reliability concerns and replaced by transaction-based rates like SOFR.

Repo rates refer to the interest charged in repurchase agreements, where one party sells securities and agrees to repurchase them later. These short-term transactions help manage liquidity and are a key indicator of funding conditions in money markets.

SOFR is a broad measure of the cost of overnight borrowing collateralized by U.S. Treasuries. It is based on actual market transactions and has replaced LIBOR as the preferred benchmark for U.S. dollar interest rates.

TGCR is a benchmark rate for overnight repo transactions backed by Treasury securities and settled on tri-party platforms. It reflects the cost of secured borrowing and is published daily by the New York Fed.

- The has been around for decades, but the rate the Fed targets may be changing.

- While we don’t expect imminent announcements or changes, we’ll be watching this space closely.

- We would expect the Fed to deliver a smooth transition, with little impact outside of money markets.

Credit Markets

Despite very heavy supply headwinds, high yield (HY) turned in a solid performance for September. HY bond yields and spreads briefly touched their multi-year and 7-month lows. The supply boom continues to be fueled by attractive yields, historically low spreads, and the prospect of easing interest rates. HY bond issuance in September totaling $59bn was the third largest ever, and yet, performance was solid with a 0.7% gain. Since 2010, monthly gross HY bond issuance has exceeded $40bn 27 times. During these 27 outcomes, the average and median HY bond return was a gain of +0.68% and +0.74%, both above the market norm. For reference, the most active months were March 2021 ($65bn) and June 2020 ($62bn).

Also, non-refi related activity of $15.9bn in September was the highest since November 2021. We have continued to see a very active M&A pipeline, including the largest leveraged buyout transaction of all time with the take-private of software maker Electronic Arts. In the context of these historically tight broad market spreads, we expect capital markets catalysts (M&A, refinancings, etc.) to remain a key theme for investors.

— Ben McCubbin and Sau Mui, Co-Heads of High Yield

- The supply boom continues to be fueled by attractive yields, low spreads, and easing interest rates.

- Capital markets catalysts such as mergers and acquisitions activity are likely to remain a key investment theme.

- Interestingly, high yield has seen above-average returns in months of strong issuance since 2010.

Equities

Markets extended their winning streak in September, with U.S. equities rising 4%. Developed ex-U.S. markets gained 2% despite ongoing political uncertainty, while Emerging Markets surged 7% — their best month since November 2023 — driven by China’s policy support and AI optimism. U.S. Small Caps also performed well, up 3%, supported by rate cut expectations and strong performance from select thematic stocks. However, large-cap breadth remained narrow, with the lagging the cap-weighted index by about 2.5%. Investor sentiment stayed resilient despite headline risks, including a U.S. government shutdown, global political tensions, and Fed independence concerns. Volatility remained subdued as markets shrugged off weak September seasonality.

Looking ahead, U.S. equities show a 12-month forward earnings growth estimate of 12%, with improving breadth and upward revisions. Expectations for four more rate cuts through 2026, alongside inflation trends that remain near forecasts, provide a constructive backdrop. We maintain our overweight to U.S. equities as recession risks fade and also continue to like Dev. ex-U.S. and Emerging Markets, supported by stimulus and global tech strength.

— Jordan Dekhayser, Head of Equity Client Portfolio Management

The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight — or 0.2% of the index total at each quarterly rebalance.

- Markets posted broad-based gains in September.

- Emerging Markets led the way, with China continuing to outperform broader Emerging Markets since policy support announced in the Fall of 2024.

- We increased global equity exposure amid reduced economic downside and strong corporate earnings; we are now overweight all three major regions.

Real Assets

The repricing of real estate assets has created a challenging environment for new capital deployment. With returns lagging behind expectations, investors have increasingly shifted their focus toward alternative asset classes such as infrastructure and private credit – sectors which have demonstrated greater resilience and more attractive risk-adjusted returns during the real estate downturn, drawing capital away from the sector.

Reflecting this shift in sentiment, the average allocation to private real estate as a percentage of total investments fell to 9.6% in 2025. This marks a decline from 10.9% in 2024 and a peak of 11.7% in 2023. Notably, this is the first time allocations have dipped below 10% since ’s 2021 rankings, underscoring the extent of the pullback.

Looking ahead, real estate investors are closely monitoring the interest rate environment, with hopes that market stabilization will reignite transaction activity and signal a market bottom. A more favorable rate cycle could restore confidence and support a rebound in allocations, but for now, the asset class remains under pressure as investors prioritize liquidity and performance.

— Jim Hardman, Head of Real Assets, Multi-Manager Solutions

PERE refers to investment strategies that acquire and manage real estate assets through private equity structures. These funds aim to generate returns through property appreciation, rental income, and strategic asset management.

- Poor relative risk-adjusted performance has dampened investor appetite for real estate assets..

- Investor allocations to private real estate fell to 9.6% in 2025, as capital shifted to equities, infrastructure, and private credit.

- We reaffirm our overweight to global listed infrastructure and underweight to global real estate.

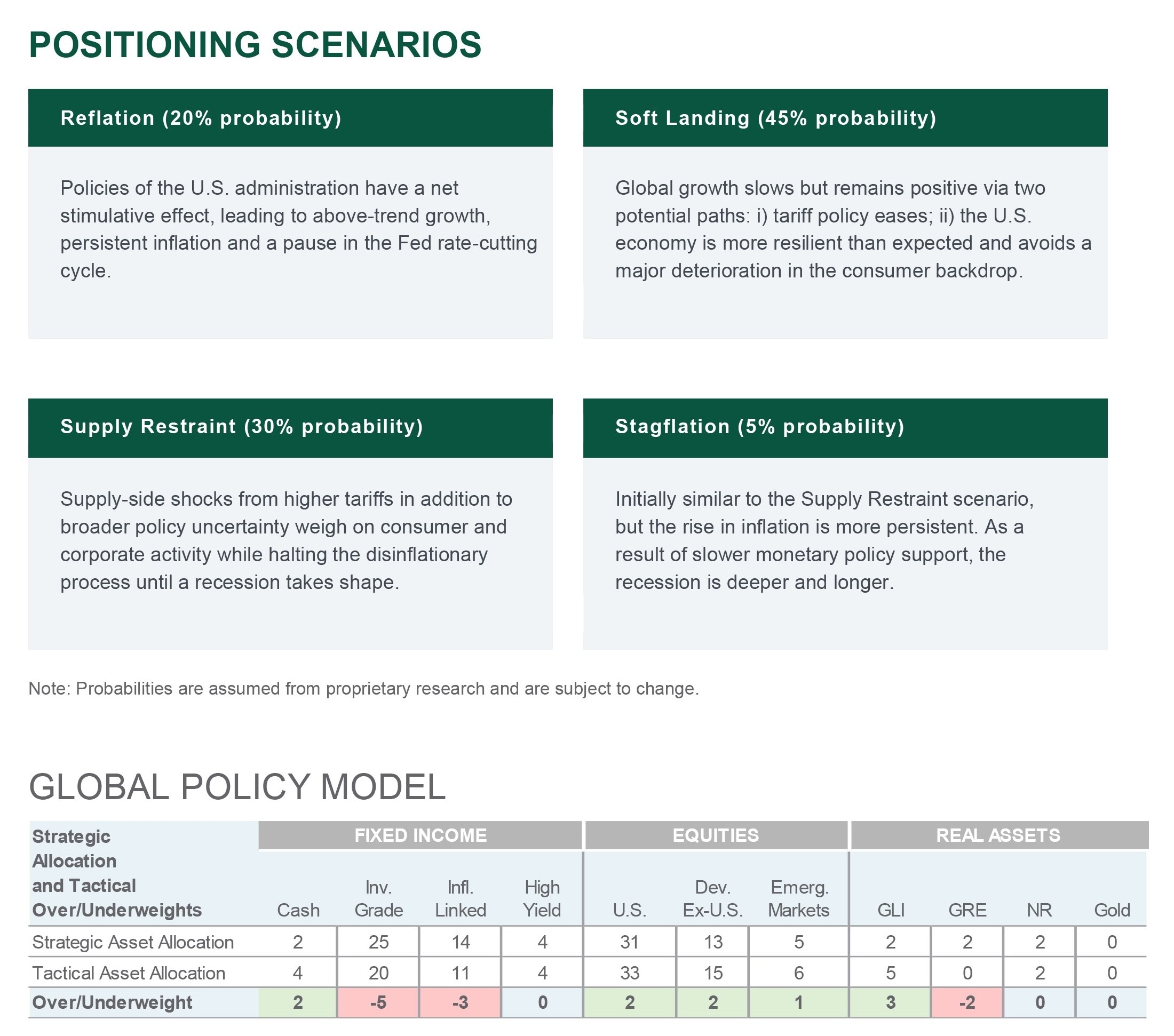

Source: Northern Trust Capital Market Assumptions Working Group, Investment Policy Committee. Strategic allocation is based on capital market return, risk and correlation assumptions developed annually; most recent model released 1/15/2025. The model cannot account for the impact that economic, market and other factors may have on the implementation and ongoing management of an actual investment strategy. Asset allocation does not guarantee a profit or protection against a loss in declining markets. GLI = Global Listed Infrastructure, GRE = Global Real Estate, NR = Natural Resources. Unless otherwise noted, the statements expressed herein are solely opinions of Northern Trust. Northern Trust does not make any representation, assurance, or other promise as to the accuracy, impact, or potential occurrence of any events or outcomes expressed in such opinions.

Unless noted otherwise, data is sourced from Bloomberg as of October 2025.

Main Point

AI Optimism Faces Supply Chain Uncertainties

The persistent escalation in tech supply chain restrictions — U.S. chip controls versus China’s rare earth leverage — now acts as a potential headwind to future earnings for leading AI technology firms, suggesting that heightened volatility may remain a feature of the evolving geopolitical landscape.

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Historical trends are not predictive of future results.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee