- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

U.S. Private Credit: What the Markets Are Missing About Attractive Risk-Reward Tradeoff

There are attractive investment opportunities in private credit against a backdrop of a U.S. economy that continues to outpace the eurozone and the U.K.

- Markets & Economy

- Fixed Income Insights

Key Points

What it is

We highlight recent attractive returns in private credit, a growing asset class.

Why it matters

In a period of tight yield spreads, achieving higher yields while being compensated for the risk is attractive for accredited investors.

Where it's going

Attractive yields from private credit appear sustainable as both demand and supply grow for the asset class in an environment of low default rates.

The following insights are curated from our March 26, 2024 “What’s the Market Missing?” webcast featuring Angelo Manioudakis, Northern Trust Asset Management’s global chief investment officer and Chief Economist Carl Tannenbaum.

“What’s the Market Missing?” is a monthly webcast designed for investors, financial professionals, and anyone eager to bolster their financial expertise. Each session offers strategic portfolio considerations, market risk cues, and innovative risk strategies.

is benefiting from a structural shift away from lending by banks,” as Angelo Manioudakis, Northern Trust Asset Management’s global chief investment officer, explained in his March 26, 2024, presentation on “What the Market’s Missing” with Chief Economist Carl Tannenbaum. The asset class appears positioned to benefit from a good balance between demand and supply. It also benefits from the strength of the U.S. economy, supported by underappreciated themes, including government spending, immigration and relatively loose credit.

Returns Attract More Investors

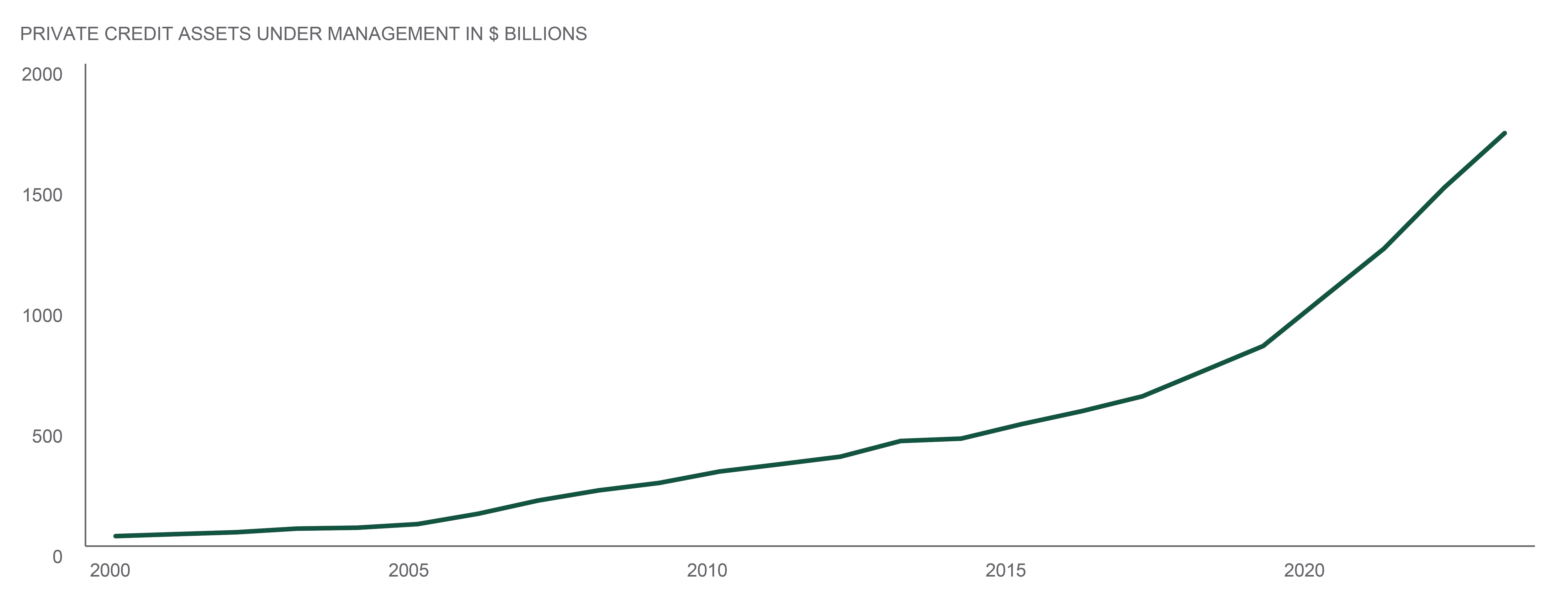

Historical returns in the range of 9-12% are into private credit — loans made directly by nonbank lenders. Demand has grown steadily, with private credit assets under management rising from about $41.5 billion in 2000 to about $1.7 trillion as of Dec. 31, 2023. (Exhibit 1).

Some might wonder if there is enough supply of private credit to satisfy this growing demand without forcing investors to take more risk or to accept lower returns to maintain a similar level of risk. However, the supply of private credit benefits from a structural trend that appears unlikely to end soon.

Private credit refers to nonbank financial entities making loans to borrowers.

EXHIBIT 1: PRIVATE CREDIT HAS GROWN AT A RAPID CLIP

Source: Northern Trust Asset Management, Bloomberg. Preqin. AUM is assets under management. Annual data from 12/31/1999 through 12/31/2023.

Plenty of Room for Supply to Grow

Disintermediation of bank lending is a long-term trend boosting the supply of private credit. Banks are cutting back on their lending. Their cutbacks aren’t just a function of the economic cycle, which does contribute modestly. Three factors are driving the structural shift in lending:

- Stricter capital requirements make lending less attractive for banks, which find fee-oriented businesses — such as wealth management and asset management — more attractive.

- Banks are receiving fewer deposits as customers migrate to money market funds paying higher rates. This means they have less funds available to make loans.

- Borrowers appreciate the greater flexibility of private credit, which can offer flexible terms, faster loans and less regulation.

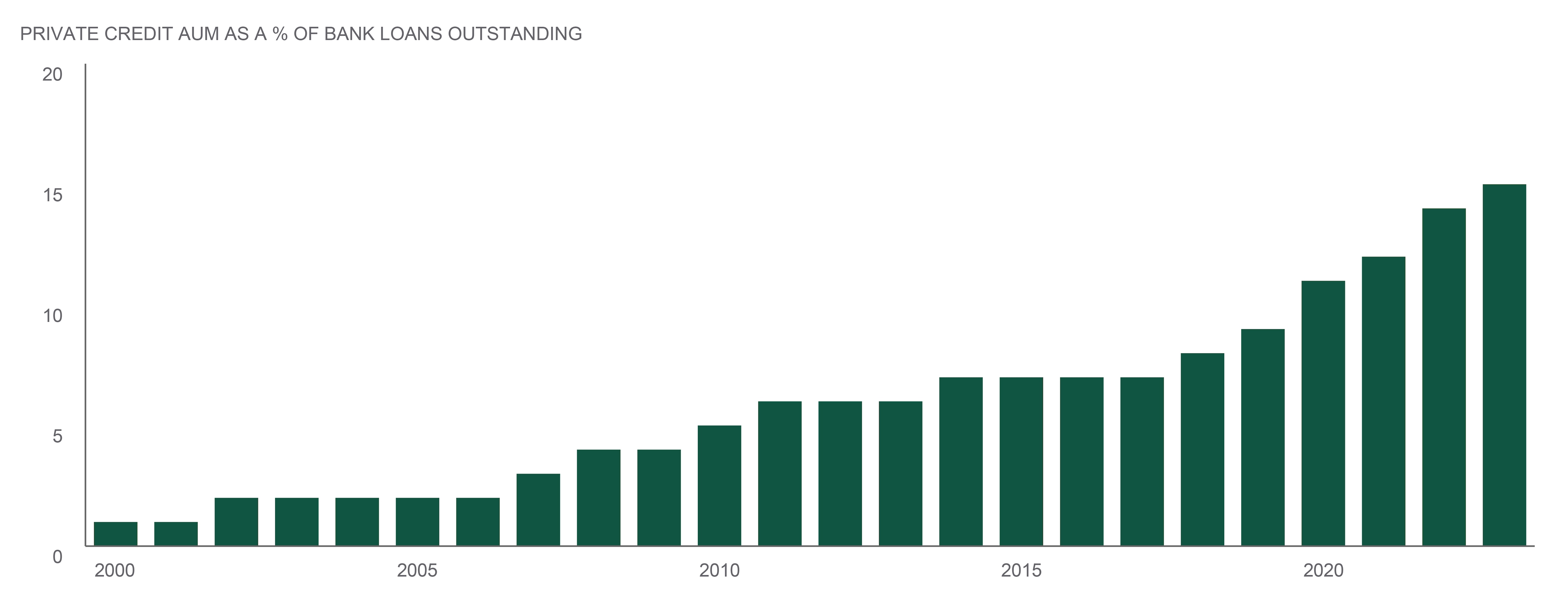

EXHIBIT 2: PRIVATE CREDIT ACCOUNTS FOR A SMALL PERCENTAGE OF BANK LOANS OUTSTANDING

Private credit has grown from only 1% of bank loans outstanding in 2000 to 15% of the total in 2023. There’s plenty of room for supply to grow.

Source: Northern Trust Asset Management, Bloomberg. Preqin. AUM is assets under management. Annual data from 12/31/1999 through 12/31/2023.

Opportunities and Risks

In terms of which capitalization of lenders to favor within private credit, Manioudakis finds small- and mid-cap borrowers appear particularly attractive. That’s because banks’ continued lending will tend to favor large-cap companies with which they have global relationships.

As for sectors, Northern Trust Asset Management emphasizes technology, healthcare and industrials because those are the focus of the private equity firms that are many of the borrowers in the firm’s sponsor-backed private credit vehicles. However, it is attractive to also diversify across industries.

Of course, risks accompany opportunities. Due to a lack of robust historical data for this relatively new asset class, it’s hard to say how private credit might respond to a credit crunch. However, private credit default rates have been low — like the rates for other fixed income in this environment of low rates and ample liquidity.

Northern Trust Asset Management seeks to manage default risk by favoring private equity sponsor-backed loans. The advantage of working with a private equity sponsor is that the sponsors have strong incentives to make sure the loans get paid off to preserve their equity. Moreover, within these funds, it’s attractive to focus on first lien, senior secured debt in the specific companies in which the private equity firm has invested. That puts the fund at the very top of that capital stack, which provides a high probability of repayment, shorter maturities because these loans tend to recycle quickly and usually collateral from the specific underlying company that backs up loans, which makes for a higher recovery value in the event of default.

Speaking of default, there is a positive U.S. economic environment that supports low default rates. Among other things, the U.S. economy remains much stronger than those of other developed nations — including the eurozone and the U.K. — due to continued federal government spending, immigration’s contribution to economic growth and easing wage inflation in service industries and relative ease of borrowing, as reflected in financial conditions indexes.

Of course, this could change if there were a crisis on the scale of the Global Financial Crisis of 2008. All lending would be affected.

Manager Selection to Mitigate Risk

To manage risk, investors could select managers carefully, which includes seeking managers that are skilled at fundamental analysis and have long-term relationships with the sponsors with whom they invest.

Most private credit funds are leveraged 0-3x at the fund level. Investors should examine those ratios to determine the extent to which high returns are due to leverage ratios instead of manager skill.

Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust, and are subject to change without notice.

Main Point

Opportunities in U.S. Private Credit

Private credit — loans made directly by nonbank lenders — has offered returns in the range of 9-13% during the past few years. The asset class appears poised to continue benefiting from attractive demand-supply dynamics.

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTI or its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTI or its affiliates’ efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTI or its affiliates. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2a of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are NTI or its affiliates’ current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.