- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Government Shutdown and Labor Market Risks

How U.S. equities historically have reacted to government shutdowns, and what may happen this time.

- Markets & Economy

- Volatility & Risk

- Equity Insights

- Market Views

Key Points

What this is

We analyze what has occurred in past shutdowns, and what investors should look for if a shutdown occurs next week.

Why it matters

A potential U.S. government shutdown poses risks to the labor market.

Where it's going

Historically, the drag from shutdowns has tended to be short-lived.

September 25, 2025

The U.S. faces a likely government shutdown on October 1, with prediction markets assigning a 65% chance. Both parties remain entrenched, showing little interest in a continuing resolution. A temporary shutdown appears to be a reasonable base case.

Shutdowns are a recurring feature of U.S. politics, with 20 funding gaps since 1976 — only four lasting more than a day. The longest was 35 days in 2018–2019; others averaged 14 days. If a shutdown occurs on October 1, it will likely be a full one, affecting all discretionary agencies, similar to the 16-day shutdown in 2013.

EXHIBIT 1: S&P INDEX RETURNS SURROUNDING MULTI-DAY GOVERNMENT SHUTDOWNS (%)

Northern Trust Asset Management, Macrobond, S&P Global. Data through 12/31/2024. Past performance is not a guarantee of future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. The S&P 500 Index represents large-cap U.S. equities.

Markets have demonstrated a remarkable ability to adapt and recover from these disruptions over the years. At most, shutdowns have led to only small and temporary softness in U.S. equities. In all four of the prior multi-day shutdowns, U.S. equities were higher 30 days following the start of the shutdown. Some risk can be priced in ahead of time, as investors anticipate the possibility of some policy disruption. For example, in the month leading up to the 2018 shutdown, U.S. equities lost over 15%. However, the environment leading up to that episode was much different than today. There were other market influences at play, including Federal Reserve rate hikes.

From an economic perspective, the overall drag from shutdowns has also tended to be short-lived. Discretionary spending represents around 30% of federal spending. Core entitlement programs that represent the bulk of federal spending remain unaffected, helping to limit the direct economic impact for most Americans. Most impacts from furloughed government workers usually reverse once the government reopens. Businesses and local economies that rely on federal contracts can also experience some turbulence.

The current situation poses labor market risks due to Office of Budget and Management directives urging agencies to consider RIFs (reduction in force) where funding may lapse. Permanent layoffs on par with furloughs in previous shutdowns would likely have a sizeable economic impact. While mass layoffs are a concern, it’s unclear if the threat is a negotiation tactic. Key details — such as the number of affected employees and legal feasibility — remain uncertain. We also note parallels to DOGE actions earlier this year, through which we haven’t seen major disruptions materialize yet. Lastly, the size of the government workforce has been declining for most of this year. We should expect this to continue to trend toward 2022 levels. Today, federal jobs as a share of total employment sit under 2%. Smaller, dispersed layoffs may be manageable, though still unhelpful in a weak labor market.

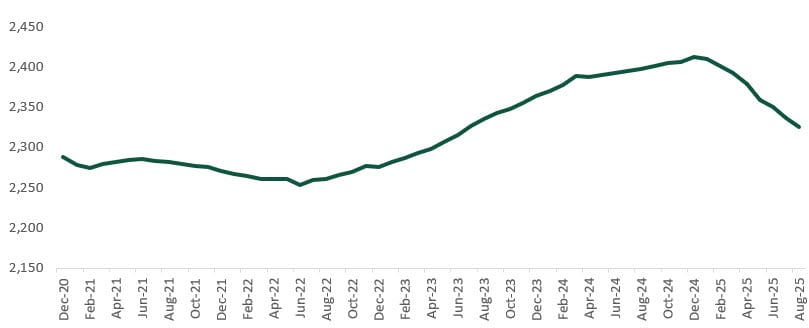

EXHIBIT 2: CIVILIAN FEDERAL JOBS EXCLUDING POSTAL WORKERS (1,000s)

Source: Northern Trust Asset Management, Bloomberg, from December 2020 to August 2025.

A key challenge for investors and the Fed is the possible delay of vital data releases like September jobs and inflation reports. This hampers the Fed’s data-driven approach, though shutdown-related growth and labor risks may reinforce expectations for an October rate cut. Fortunately, markets have also improved in using alternative data sources to navigate traditional data gaps.

Political uncertainty remains, but history suggests a compromise will likely restore stability and support a rebound in economic and market sentiment. While headlines may drive short-term volatility, long-term investors focused on fundamentals have typically been rewarded. As negotiations unfold, we’ll continue monitoring developments around potential agreements, labor market risks, and policy changes.

Main Point

History shows a compromise likely

Political uncertainty remains, but history suggests a compromise will likely restore stability and support a rebound in economic and market sentiment. While headlines may drive short-term volatility, long-term investors focused on fundamentals have typically been rewarded.

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

For Canada, Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. This information may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of NTAM. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Historical trends are not predictive of future results.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide a recommendation or give investment advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and/or its affiliates may receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee