- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Volatility Is the New Normal — Are You Ready?

Quality Low Volatility: The Smart Advantage for Institutional Portfolios

- Portfolio Construction

- Equity Insights

- Active Equity

- Factor Investing

Today, volatility isn’t a blip on your radar; it’s the landscape. The question isn’t if, but when the next market shaking event will hit your portfolio. So, are you equipped — or exposed?

At Northern Trust Asset Management (NTAM), we’re not just navigating volatility; we’re redefining how sophisticated investors turn it into opportunity. Our Quality Low Volatility (QLV) strategies aren’t just a defensive play — they’re an institutional edge designed for today’s relentless uncertainty.

The Volatility Surge: Why Traditional Responses Fall Short

Since 2007, the frequency and magnitude of market shocks have multiplied. Traditional diversification models can leave you flat-footed when volatility strikes hardest.

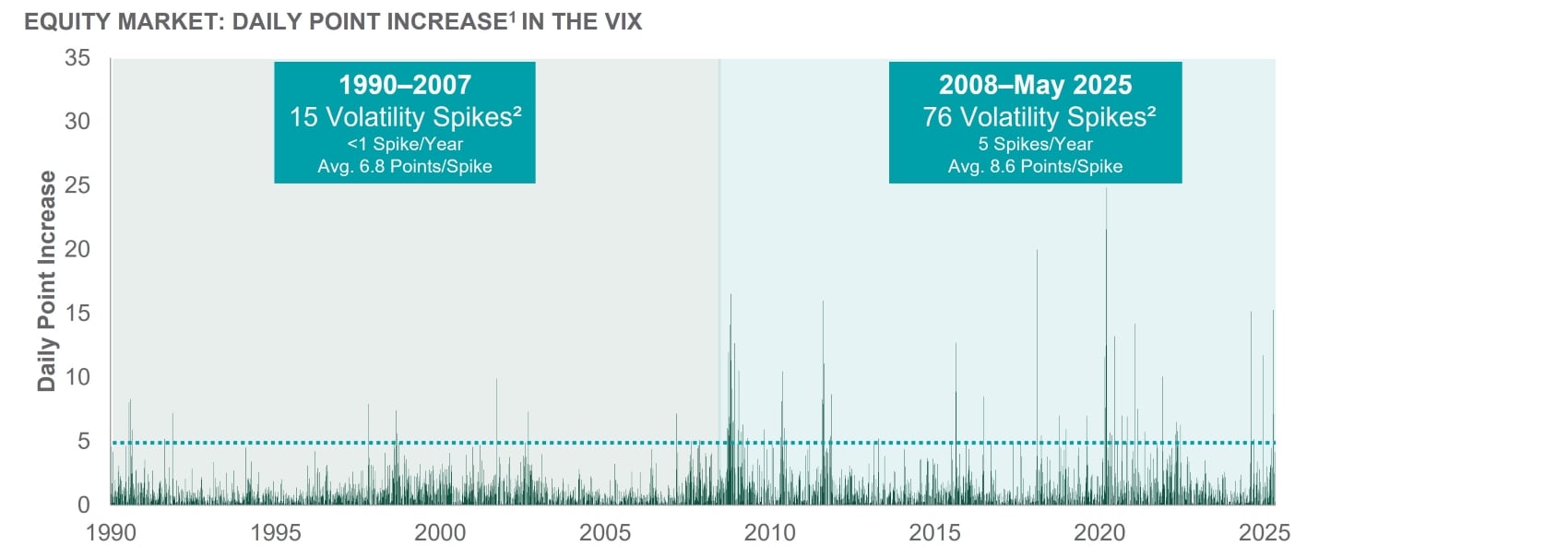

EXHIBIT 1: Increase in One-Day Volatility Shocks Since 1990

1 Volatility increases are represented by any increase in the VIX daily, as of 5/31/2025.

2 Volatility shocks are any increase in the VIX daily greater than five points.

Source: Northern Trust Asset Management, Factset. Past performance is no guarantee of future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

Volatility spikes are more frequent and sharper on the downside, yet markets continue to climb — revealing an asymmetry that traditional diversification struggles to address.

Turning Volatility Into Alpha: The Northern Trust QLV Difference

This isn’t about hiding from risk — it’s about managing it on your terms. QLV strategies leverage proprietary research to identify equities that can navigate turbulent markets and support your portfolio's growth. By integrating forward-looking quality signals with disciplined volatility control, QLV avoids the sector biases and defensive drag common to conventional low-volatility approaches.

- Not Just Defensive, But Resilient: QLV is built to withstand market stress through disciplined exposure to quality and volatility factors — providing stability without sacrificing long-term growth potential.

- Asymmetric Return Profiles: QLV seeks to capture more upside while aiming to mitigate downside — developed with institutional mandates in mind that prioritize more than basic risk reduction.

- Quality Edge: QLV targets companies with strong fundamentals — profitability, cash flow, and management efficiency — using quality as a forward-looking signal to reduce future volatility and enhance risk-adjusted returns.

Asymmetric Return Profiles: Capture More Up, Protect More Down

Low volatility equities, with their defensive characteristics, have tended to demonstrate an asymmetric return profile — limiting losses in down markets while still participating in up markets. These characteristics are important for investors aiming to optimize their risk-return profile while effectively managing potential drawdowns. This balance is especially valuable in today’s environment of frequent market extremes.

Your Next Move: Lead With Intelligence

Volatility evolves — your strategy should too. NTAM’s Quality Low Volatility approach redefines resilience, helping institutional investors turn uncertainty into a durable edge.

Let’s talk about building a portfolio that keeps you on the offensive, no matter what the market throws at you.

Main Point

At NTAM, we’re not just navigating volatility; we’re redefining how sophisticated investors turn it into opportunity. Our Quality Low Volatility (QLV) strategies aren’t just a defensive play — they’re an institutional edge designed for today’s relentless uncertainty.

What the U.S. Tariffs Mean for Investors

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

For Canada, Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. This information may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of NTAM. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Historical trends are not predictive of future results.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide a recommendation or give investment advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and/or its affiliates may receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing, and other services rendered to various proprietary and third-party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee