- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

The Golden Ascent

We examine what’s driving gold’s ascent — from central bank reserves to portfolio hedging — and why it can play a strategic role for investors.

- Portfolio Construction

- Volatility & Risk

- Multi-Asset Insights

- Markets & Economy

Key Points

What it is

We examine gold’s strong 2025 performance and its evolution from a “Golden Constant” store of value into a dynamic portfolio asset.

Why it matters

Gold may hedge against inflation and geopolitical risk, and surveys indicate that investors are under-allocated.

Where it's going

In an increasingly fragile world, the gold has taken on a more strategic role.

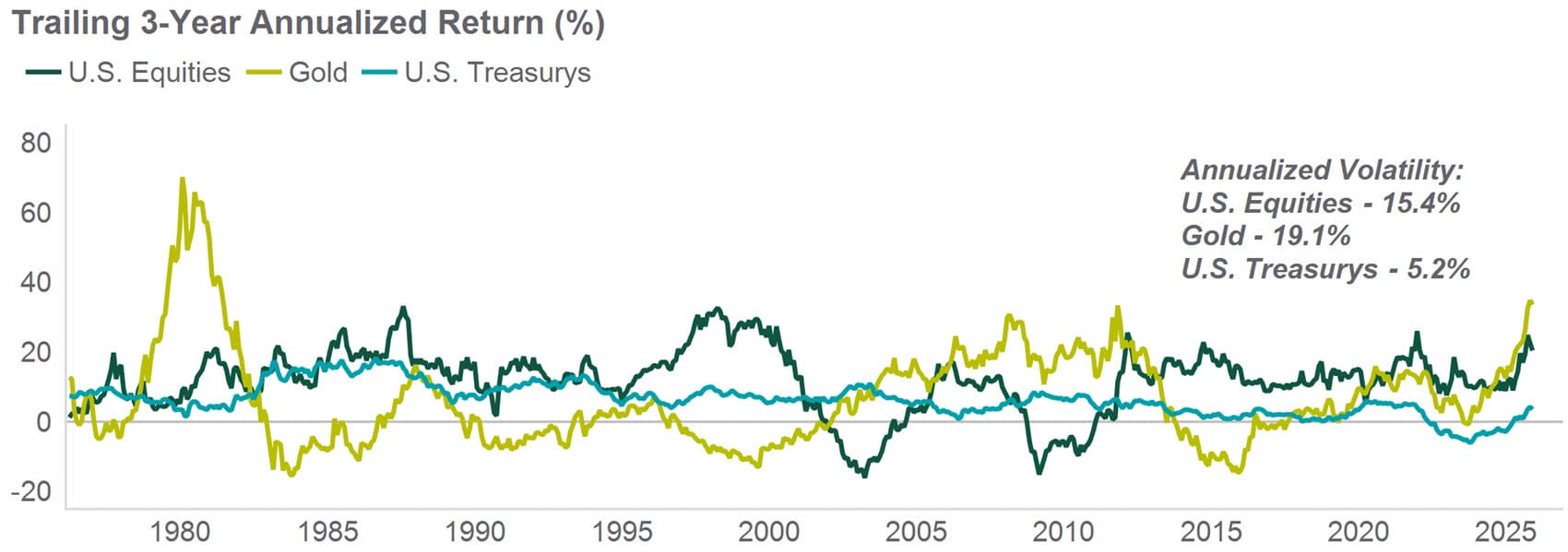

In a year of strong financial market returns, few assets have stood out more than gold. Across centuries, Gold has transformed from a static store of value — the “Golden Constant” — into a dynamic portfolio asset. Historically, gold underpinned global currencies, with governments pegging fiat to bullion for credibility. This changed in 1971 when former U.S. President Nixon ended the gold standard, liberating the metal. Since then, gold has delivered an impressive annualized return of around 7%, warranting a new moniker: the “Golden Ascent.”

Initially, gold surged as a hedge against stagflation post-. While developed market central banks spent decades reducing their reserves, new sources of demand emerged, such as gold-backed exchange-traded funds (ETFs) that democratized retail access. A structural break occurred following Russia’s invasion of Ukraine. The subsequent freezing of Russia’s central bank reserves sent a stark message to the world: in a system where Western financial assets can be weaponized, gold remains one of the few sanction-proof markets. With slow mining supply and complex demand dynamics, price movements defy historical models. Non-linear trends and past bubbles suggest another may be forming, though fundamentals can justify current valuations.

Despite its physical scarcity, available gold is valued at roughly one-quarter of global equities, underscoring its unique asset class status. Future potential demand catalysts include gold-backed stablecoins, African gold standards, and regulatory reclassification for banks and insurers. China’s continued diversification and insurance sector adoption further support structural demand.

Gold’s low correlation to stocks and bonds enhances portfolio efficiency. Historical risk-return analysis suggests that an allocation in the range of 8–10% could enhance portfolio efficiency, with higher allocations warranted during periods of elevated volatility or inflation. Current investor surveys reveal widespread under-allocation. Gold’s ultimate utility lies in hedging “fat tail” risks — deep dollar weakness or severe geopolitical shocks, such as U.S.-China conflict. In an increasingly fragile world, the Golden Constant has taken on a more strategic role.

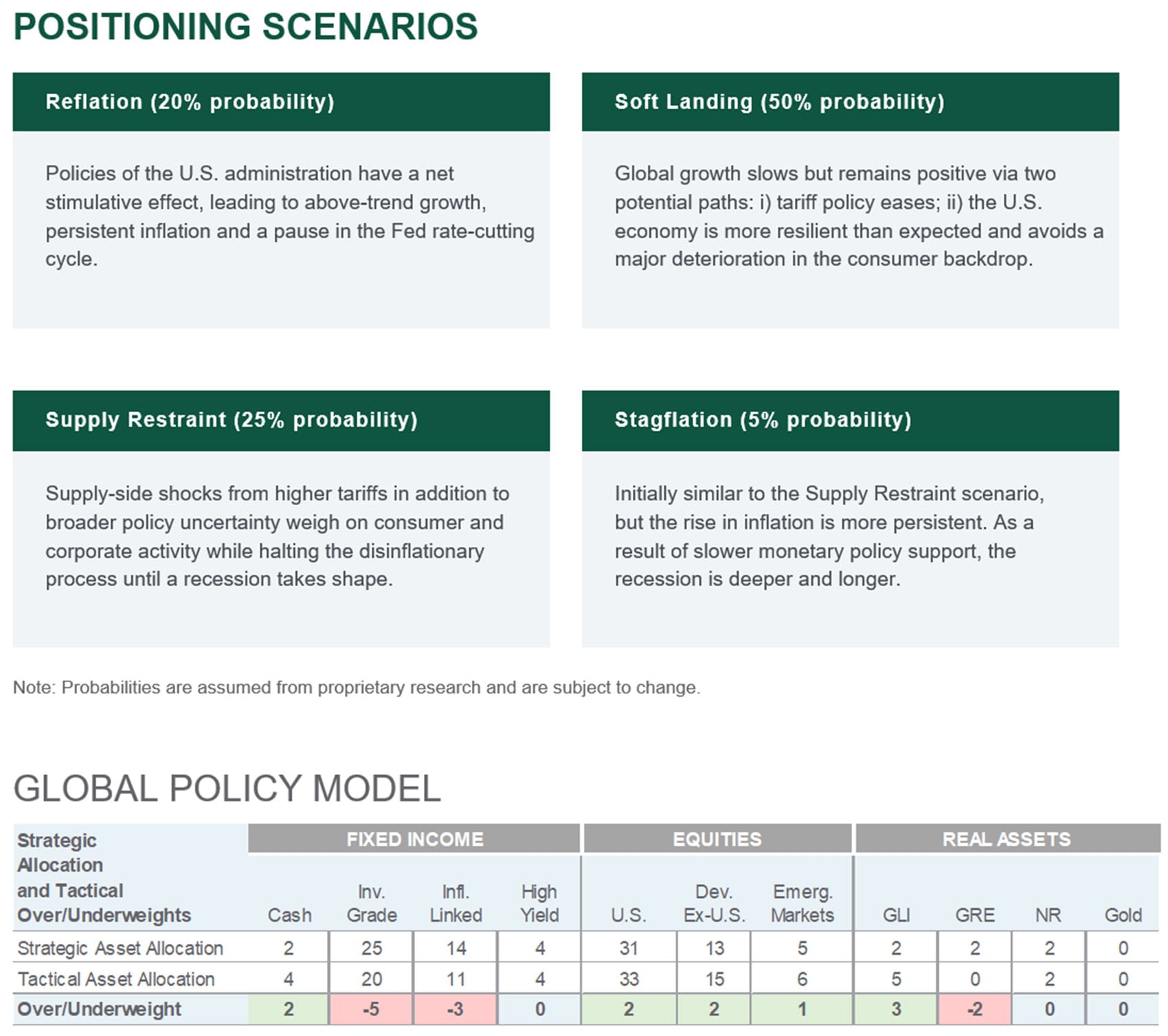

Heading into 2026, our tactical portfolio maintains a risk-on tilt, favoring equities over fixed income. Equity positioning is constructive across major regions, and we also maintain an overweight to global listed infrastructure. We continue to believe that the corporate profit growth story is more compelling than the search for yield.

— Peter Wilke, CFA – Head of Tactical Asset Allocation, Global Asset Allocation

The Bretton Woods system (1944–1971) was a post-WWII monetary framework that fixed exchange rates by pegging currencies to the U.S. dollar, which was backed by gold. This arrangement was created to enhance global financial stability and create predictable trade by anchoring currency values.

A Gold Rush

Source: Northern Trust Asset Management, Macrobond, Bloomberg. Monthly data from March 1973 through November 2025. Indexes used: S&P 500 (U.S. Equities), World Gold (Gold) and Bloomberg U.S. Treasurys (U.S. Treasurys). Past performance is not indicative or a guarantee of future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

Interest Rates

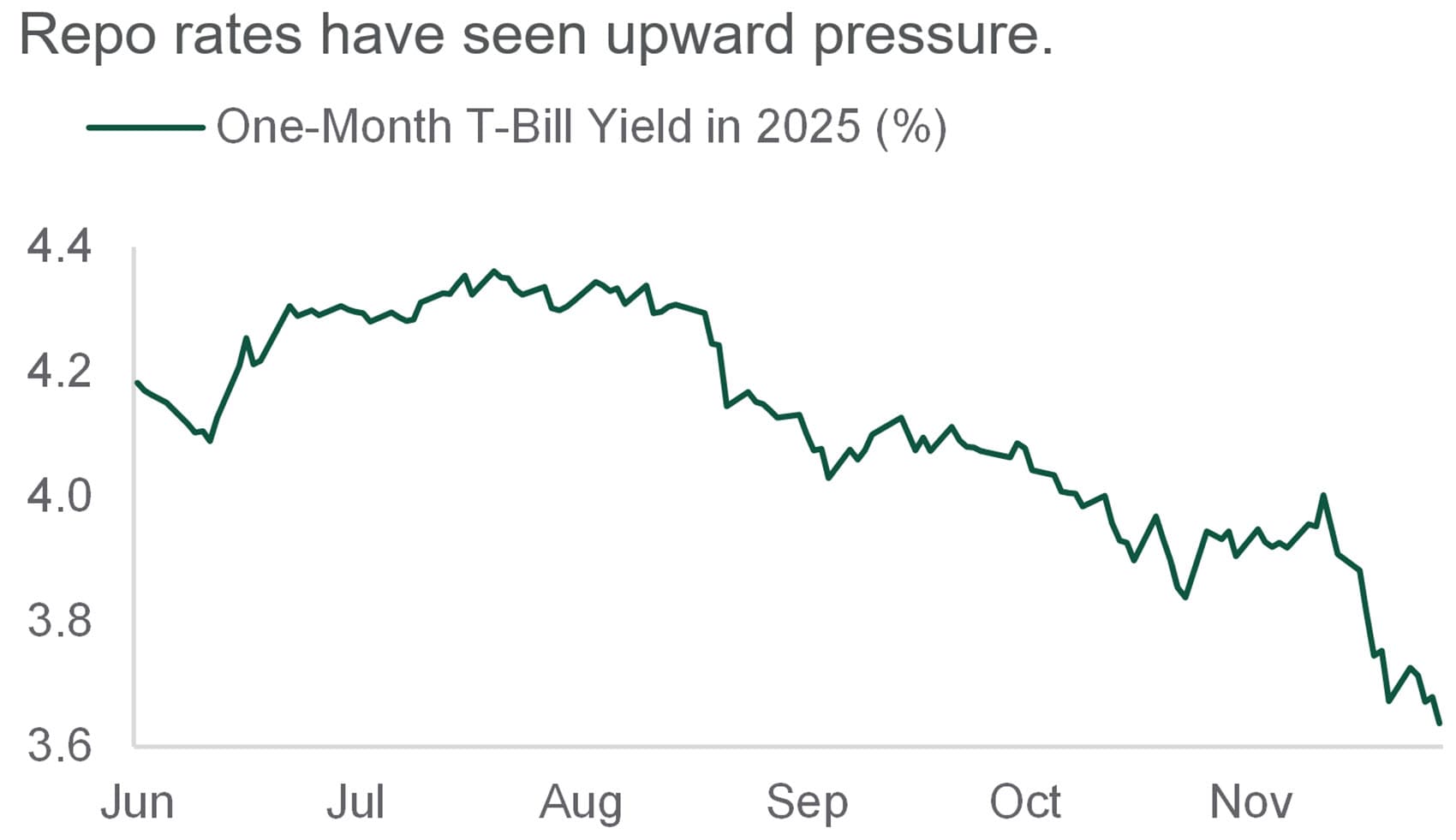

After announcing the end of (QT, or balance sheet reduction) at the October meeting, the Fed took subsequent action on monetary policy implementation at the December meeting. Reserve Management Purchases (RMPs) will be used to add reserves into the system via buying $40 billion of per month. This is in addition to the $15 billion per month in MBS proceeds also being reinvested in T-Bills. With the aggregate level of reserves already at the tipping point between “abundant” and “ample”, and seasonal demand for reserves expected to increase around year-end and into Tax Day, it was judged as appropriate to mitigate that pressure via RMPs.

While we see no implications for the stance of monetary policy as a result of the decision to implement RMPs, we did see prices for T-Bills increase in response to the announcement of RMPs. In addition to the T-Bill market, we also see downward pressure on other money market rates, like repo, as a result of RMPs. This should alleviate much of the concern around year-end disruptions in the funding markets. While we’ve written extensively on balance sheet policy over the past year, RMPs may usher in a quieter period for balance sheet policy in 2026.

— Dan LaRocco, Head of U.S. Liquidity, Global Fixed Income

Quantitative tightening is a contractionary policy the Federal Reserve uses to decrease the amount of money in the economy by selling government bonds, which increases interest rates and helps control inflation.

A Treasury bill is a loan to the U.S. government that matures in three, six or 12 months.

Reserve Management

Source: Northern Trust Asset Management, Bloomberg. T-Bill = Treasury Bill. Data from 6/16/2025 through 12/12/2025. Historical trends are not predictive of future results.

- Reserve Management Purchases (RMPs) will be used to mitigate pressure in repo and money markets.

- The Fed will be buying $40 billion of T-Bills per month in addition to the $15 billion per month in MBS proceeds also being reinvested in T-Bills.

- While we don’t see any implications for monetary policy, RMPs will likely bias money market rates lower within the target range

Credit Markets

After resolution of the longest government shutdown in U.S. history, November’s market narrative was dominated by concerns of an artificial intelligence (AI) “bubble”, driving volatility across risk assets. Against this backdrop, credit markets still generated positive returns. Within high yield bonds, modest spread widening early in the month gave way to a late-month rally, with index spreads declining 12 bps month-over-month.

Despite strong high yield returns year-to-date, there could still be room for seasonal outperformance. January has historically delivered outsized returns: the average high yield bond return over the past 39 years of +1.6% exceeds other months by about 1 percentage point. Since 1987, high yield returns have been positive 85% of the time in January. While January is typically the best month for high yield, the 30-day stretch from mid-December to mid-January averages +1.9%, more than triple a typical 30-day period. Recall, high yield bonds posted a -0.4% loss in December 2024 as the Fed delivered a hawkish cut, followed by a +1.5% gain in January.

— Ben McCubbin and Sau Mui, Co-Heads of High Yield

The January Effect

Source: J.P. Morgan. Data from 1987 through 2024. HY = High Yield. Historical trends are not predictive of future results.

- Despite the strong high yield returns year-to-date , there could still be room for outperformance from a seasonal perspective.

- January’s average high yield bond return over the past 39 years of +1.6% exceeds the average for all other months by about 1 percentage point.

- Since 1987, high yield returns have been positive 85% of the time (33 out of 39) in January

Equities

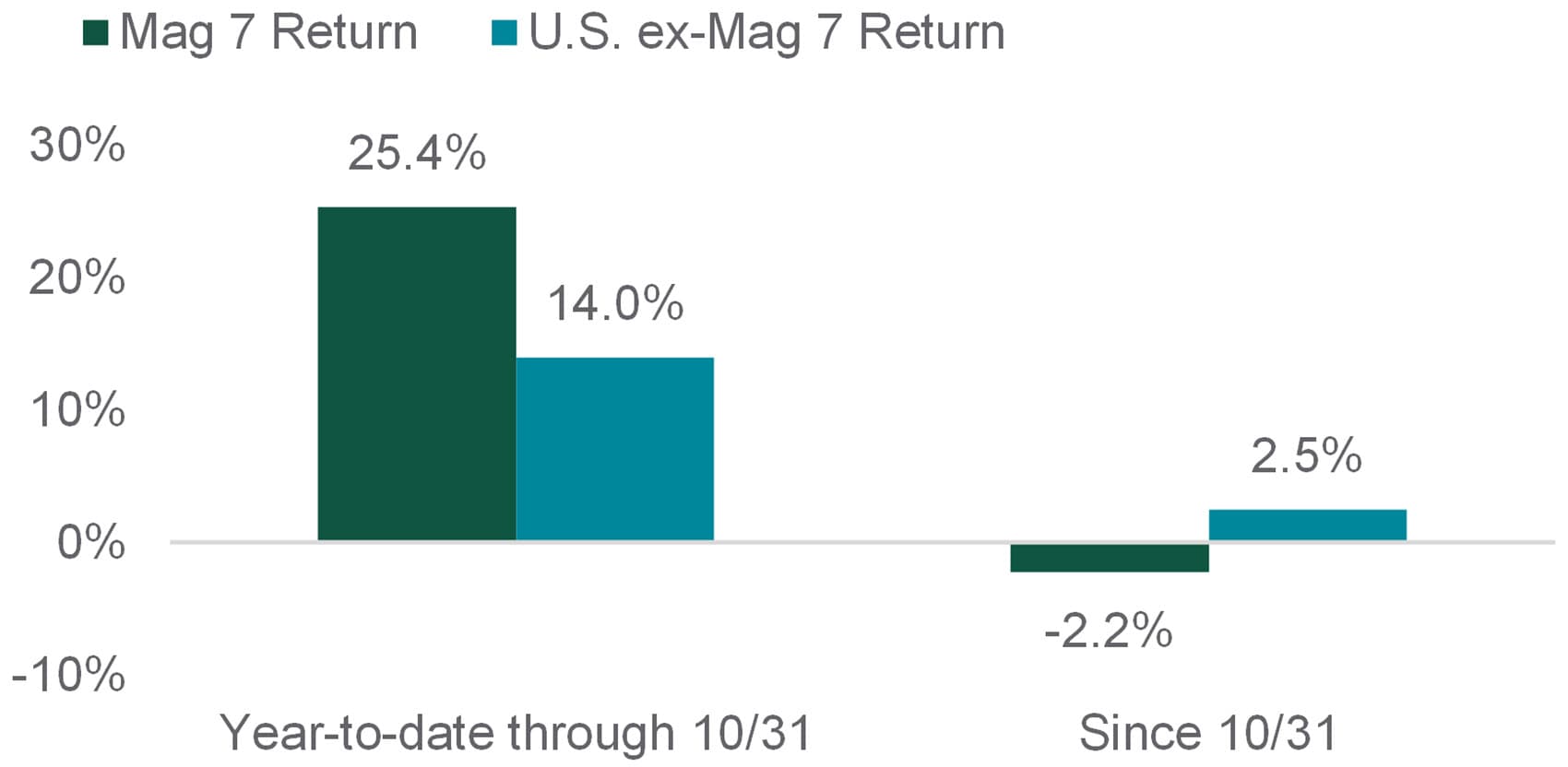

November markets echoed October’s pattern: a sharp mid-month drop followed by recovery. U.S. equities fell 4.5% through November 20 but rebounded to finish flat. Developed ex-U.S. markets gained 1%, while Emerging Markets declined 2.4%, pressured by China’s tech weakness — similar to U.S. trends. Volatility spiked but then eased — a cycle seen throughout 2025. Late November and early December showed broader market participation beyond the “.” From October-end to December 11, the rose 3.6%, beating its cap-weighted counterpart by 2.6%. Value stocks led, outperforming Growth by 4.2%. The mid-month sell-off reflected concerns over the AI ecosystem — stretched valuations, circular financing, and rising capex — but rotation toward cyclical equities signaled a better backdrop.

The macro backdrop and fundamentals remain supportive. Valuations are elevated, but earnings expectations have continued to improve across sectors. U.S. equities show 14% forward earnings growth. We favor U.S. equities over bonds as recession risks fade. We also see opportunities in Developed ex-U.S. and Emerging Markets, supported by policy, resilient earnings, and global tech leadership.

— Jordan Dekhayser, Head of Equity Client Portfolio Management

The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight — or 0.2% of the index total at each quarterly rebalance.

The “Magnificent Seven” companies are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, which drove the sharp rise in U.S. stocks in 2023.

More than the Mag 7

Source: Northern Trust Asset Management, MSCI. Data from 12/31/2024 through 12/11/2025. Past performance is not indicative or a guarantee of future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

- November saw a sharp mid-month sell-off followed by recovery, with mixed results across regions.

- Leadership broadened beyond mega-cap tech, with value and equal-weighted stocks gaining traction.

- Supportive fundamentals and healthy earnings keep us constructive on global equities.

Real Assets

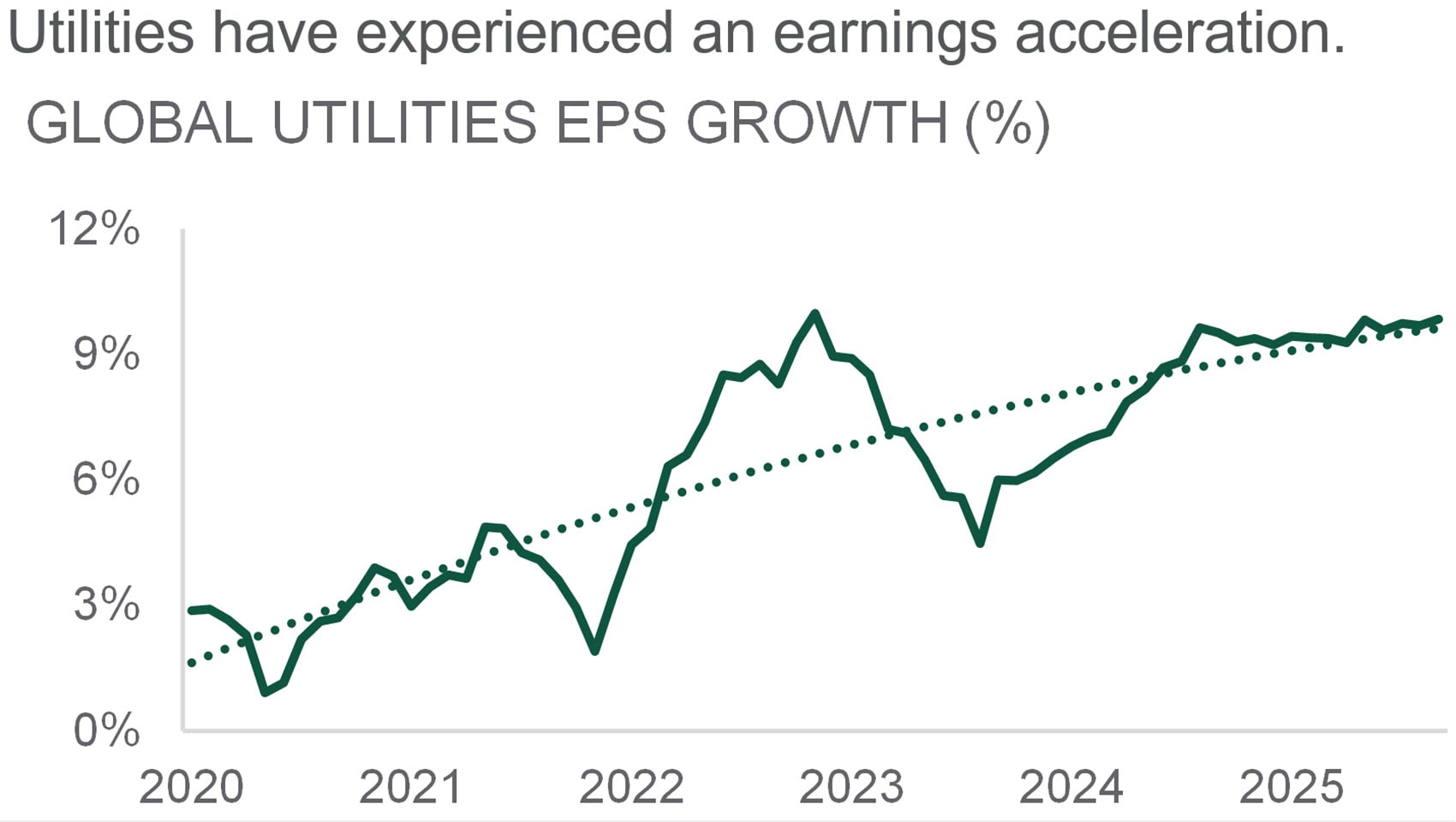

After decades of moderate (2-3%) earnings per share growth, the utilities sector has entered a new era of expansion, with growth now more than double its historical rate. This acceleration is not a short-term anomaly but the result of powerful structural shifts reshaping global energy demand. The primary drivers of this shift are: 1) the surge in power consumption from tech companies powering cloud computing and AI workloads; 2) the broad-based electrification of transportation and industrial processes; and 3) investment in grid modernization to support increasing electricity loads and resilience.

These transformative trends position utilities at the heart of the energy transition, creating a sustainable growth trajectory. Utilities operate under a regulated framework that enables predictable cash flow growth through rate adjustments. Historically, the sector has delivered lower earnings volatility and superior cash flow visibility compared to the broader equity market. This unique combination of structural growth drivers and defensive characteristics positions utilities as a compelling option for investors seeking capital preservation alongside meaningful upside potential.

— Jim Hardman, Head of Real Assets, Multi-Manager Solutions

Surge Ahead

Source: Northern Trust Asset Management, First Sentier Investors. EPS = earnings per share. Data from 3/31/2020 through 11/30/2025. Historical trends are not predictive of future results.

- Global utility earnings growth has doubled over the trailing 5 years due to the growth in global power demand.

- The combination of strong expected earnings and defensive characteristics positions utilities as a compelling option for investors.

- We reaffirmed our tactical overweight to listed infrastructure on compelling fundamentals and strong expected risk-adjusted returns.

Source: Northern Trust Capital Market Assumptions Working Group, Investment Policy Committee. Strategic allocation is based on capital market return, risk and correlation assumptions developed annually; most recent model released 1/15/2025. The model cannot account for the impact that economic, market and other factors may have on the implementation and ongoing management of an actual investment strategy. Asset allocation does not guarantee a profit or protection against a loss in declining markets. GLI = Global Listed Infrastructure, GRE = Global Real Estate, NR = Natural Resources. Unless otherwise noted, the statements expressed herein are solely opinions of Northern Trust. Northern Trust does not make any representation, assurance, or other promise as to the accuracy, impact, or potential occurrence of any events or outcomes expressed in such opinions.

Unless noted otherwise, data is sourced from Bloomberg as of December 2025.

Main Point

Gold Ascends as a Strategic Asset

Gold has evolved from a static pillar of monetary value into a dynamic strategic asset. Since the end of the gold standard in 1971, it has delivered ~7% annualized returns, rivaling equities. Its scarcity, low correlation to other assets and “sanction-proof” status have enhanced its appeal as a portfolio hedge amid rising global risks.

Contact Us

Interested in learning more about our expertise and how we can help?

IMPORTANT INFORMATION

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Historical trends are not predictive of future results.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Not FDIC insured | May lose value | No bank guarantee